Chartered accountants, often perceived as the bedrock of financial expertise, have a history teeming with intriguing narratives and surprising twists. From the historic establishment of the accounting profession in the 19th century to the groundbreaking entry of women into the field, their journey is rich with milestones.

These professionals have not only shaped financial practices but have also witnessed and adapted to monumental changes in the economic landscape. Their roles have extended beyond traditional boundaries, influencing various sectors and leaving an indelible mark on global finance. Discover more in these fun facts about chartered accountants.

1. The Origin of the Chartered Accountant Title

The designation “Chartered Accountant” was formally established in 1854 with the founding of the Institute of Chartered Accountants in England and Wales (ICAEW). This significant event in financial history was marked by the royal charter granted by Queen Victoria, distinguishing chartered accountants from other accounting practitioners.

This recognition elevated the status of the profession, setting a global precedent for accounting standards and practices. It represented a shift towards more rigorous standards in financial reporting and accountability.

2. First Women in Chartered Accountancy

In 1920, Mary Harris Smith made history by becoming the first woman recognized as a chartered accountant, breaking into the male-dominated field. Her admission into the ICAEW was more than a personal achievement; it represented a monumental shift in the profession, challenging the gender norms of the time.

Her struggle and eventual success laid the groundwork for the inclusion of women in accounting, signaling a progressive change towards gender equality in the profession.

3. Accounting During Wartime: A Crucial Role

Accountants played an indispensable role during World War II, managing the complex economies of wartime. They were responsible for the efficient allocation of resources, auditing military expenditures, and strategizing for post-war economic recovery. Their expertise ensured transparent and effective use of funds, which was critical for the war effort and subsequent rebuilding.

This period highlighted the strategic importance of accounting in national security and economic stability.

Image: communitystories.ca

4. Rock Stars Who Were Chartered Accountants

Believe it or not, some of the rock world’s legends started their careers as Chartered Accountants. A notable example is Mick Jagger, the iconic frontman of The Rolling Stones, who attended the London School of Economics on an accounting scholarship before pursuing music.

His shift from the financial world to rock stardom is a testament to the diverse paths that individuals can take in their careers. Jagger’s early academic pursuit in accountancy showcases a unique juxtaposition between the orderly world of finance and the creative realm of music.

Image: The Today Show

5. Chartered Accountants in Global Financial Crises

During the 2008 global financial crisis, chartered accountants were at the forefront of addressing complex financial challenges. Their skills in auditing, compliance, and financial analysis were crucial in untangling the intricate financial issues that emerged. They played key roles in restructuring distressed companies, guiding bankruptcies, and advising on financial stability strategies for governments and corporations.

This period underscored the indispensable role of chartered accountants in maintaining economic stability during turbulent times.

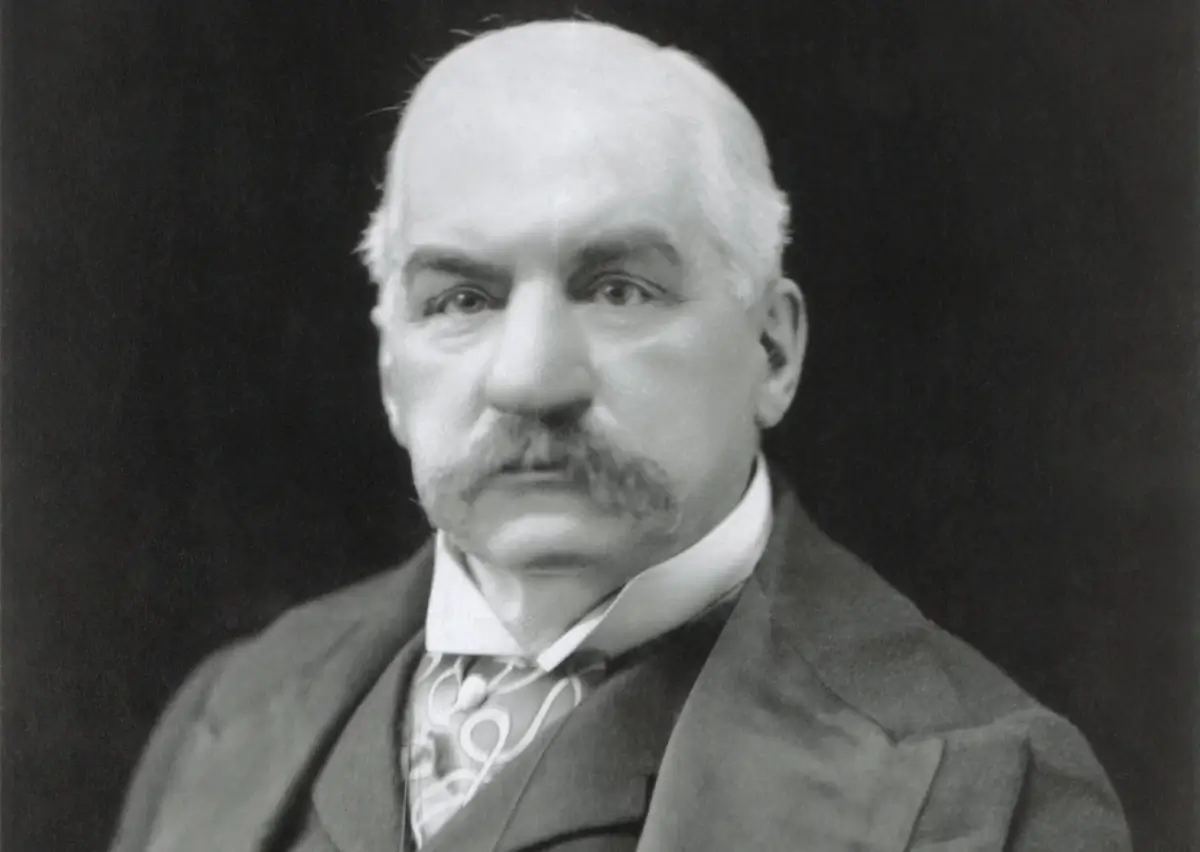

6. Famous Chartered Accountants in History

John Pierpont Morgan, an iconic figure in banking and finance, began his illustrious career as an accountant. His transition from accounting to becoming the founder of J.P. Morgan & Co. illustrates the vast potential and influence of the accounting profession.

Morgan’s journey highlights how foundational skills in accounting can lead to significant impact in the broader financial world, shaping the modern banking system and influencing global finance.

Image: mavink.com

7. Chartered Accountants’ Legal Duties

Chartered Accountants are bound by legal duties that include maintaining confidentiality, exercising due diligence, and adhering to financial laws and standards. These duties are critical for ensuring trust and integrity in financial reporting and advising.

Any breach of these legal obligations can lead to serious consequences, including legal action and loss of licensure, emphasizing the importance of ethical and legal compliance in the profession.

8. Chartered Accountants’ Code of Conduct

The Code of Conduct for Chartered Accountants, established by accounting bodies like ICAEW and AICPA, emphasizes integrity, objectivity, professional competence, and due care. This code ensures that accountants uphold the highest standards in their practice.

Adherence to this code is essential for maintaining public trust and the profession’s reputation, making it a cornerstone of ethical practice in accountancy.

9. Historic Accountancy Scandals

The Enron scandal in 2001 and WorldCom scandal in 2002 are among the most notorious in accounting history. Enron’s collapse, due to fraudulent accounting practices, led to a loss of $74 billion for shareholders and the dissolution of Arthur Andersen, one of the big five accounting firms. WorldCom’s scandal, involving $11 billion in fraudulent adjustments, was the largest incident of accounting fraud at the time.

These scandals precipitated the Sarbanes-Oxley Act of 2002, which introduced major changes in financial practice and corporate governance in the U.S., emphasizing the need for ethical standards and transparency in financial reporting.

Image: linkedin.com

10. Chartered Accountants’ Continuing Education

Continuing education is pivotal for chartered accountants, mandated by professional bodies like the ICAEW and AICPA. This requirement ensures they stay current with evolving accounting standards and practices.

Typically, chartered accountants must complete a set number of hours in professional development courses annually. These programs range from new tax laws to emerging financial technologies, reflecting the profession’s commitment to lifelong learning and adaptability.

11. Evolution of Chartered Accountancy Training

Chartered accountancy training has evolved significantly since the 19th century. Initially focused on apprenticeships, the training now encompasses a comprehensive educational curriculum, covering accounting principles, law, and ethics.

The introduction of formal examinations, like those initiated by the ICAEW in the 1880s, marked a significant development, standardizing the qualification process. Today’s training also includes practical experience requirements, ensuring well-rounded expertise in the field.

12. Future Trends in Chartered Accountancy

The future of chartered accountancy is poised for significant changes, driven by advancements in technology and global economic shifts. Trends like AI and machine learning are anticipated to transform traditional accounting tasks, while the increasing importance of sustainability and environmental accounting is reshaping the field.

Furthermore, globalization continues to influence the harmonization of accounting standards, requiring chartered accountants to be adept in international finance and regulations.

Image: theforage.com

FAQ

Why are accountants called chartered?

The term “chartered” in “chartered accountants” originates from the Royal Charter granted by Queen Victoria in 1854 to the Institute of Chartered Accountants in England and Wales (ICAEW). This charter recognized accountancy as a profession, distinguishing its members through rigorous qualifications and adherence to high standards. Being “chartered” implies a certain level of expertise, ethical standards, and professional commitment, which sets these accountants apart from non-chartered practitioners.

Who was the first chartered accountant?

The first chartered accountant in history is somewhat ambiguous, as the designation came into formal existence with the establishment of the ICAEW in 1854. However, John Ballantine, an Edinburgh accountant, is often recognized as one of the first chartered accountants. The first president of the ICAEW, William Quilter, also holds a notable place in the early history of chartered accountancy.

What can a chartered accountant do?

Chartered accountants are qualified to perform a variety of tasks in the field of accounting and finance. These include auditing financial statements, providing financial advice, tax planning, managing financial systems and budgets, forensic accounting, and business consulting. They play a crucial role in financial reporting and compliance, and can also hold leadership roles in business strategy and decision-making.

What is the lifestyle of a chartered accountant?

The lifestyle of a chartered accountant can vary greatly depending on their area of specialization and the type of organization they work for. Generally, it involves a significant amount of time analyzing data, preparing reports, and advising on financial matters. Many chartered accountants work in a fast-paced environment with strict deadlines, which can mean long hours, especially during financial year-ends or tax season. However, the profession also offers opportunities for flexible working arrangements and can be quite rewarding.

Why is being chartered important?

Being chartered is important because it signifies a high level of professional competence and ethical standards. Chartered accountants undergo rigorous training and examinations, and are required to commit to continuous professional development. This status provides assurance to clients and employers of their expertise and dedication to upholding the standards of the profession. It also enhances their credibility and reputation in the field of accounting and finance, opening up more advanced career opportunities.